In 2017, Asia is once again poised to be the growth engine of global GDP and maybe having even more of an importance as a result of US tightening their international trade relations and abandon the Trans Pacific Partnership TPP. This is naturally having a negative impact on global trade and value chains. However it is also opening up opportunities for the remaining 11 nations within TPP to tightening their relations and also looking more towards China and their partnerships with Europe. The Australian government will push ahead for a Trans-Pacific Partnership trade deal without the United States and is open to Indonesia, China and others seeking to join the agreement.

Association of Southeast Asian Nations ASEAN is continuing to increase in importance as China moves away from manufacturing and restructures into a consumption and services based economy. ASEAN is become Asia’s main investment hub, moving towards a single market with ASEAN Economic Community AEC. ASEAN is now the third biggest economy in the world after China and India, following by United States, Brazil, European Union, Japan and Russia.

ASEAN’s 625 million population (Indonesia makes up 40% of this) represents nearly 10% of the world’s population and 40% of total population is below 30. For the last 4 years, ASEAN outdid China on FDI as well as minimum daily wage. China is no longer competitive in comparison to some ASEAN countries.

FDI Trend

With the global economy slowdown, FDI investment for Indonesia’s secondary sectors has been cooled. A big drop from 16 US$ billion in 2013 to 9 US$ billion in 2015 (Jan – Sept).

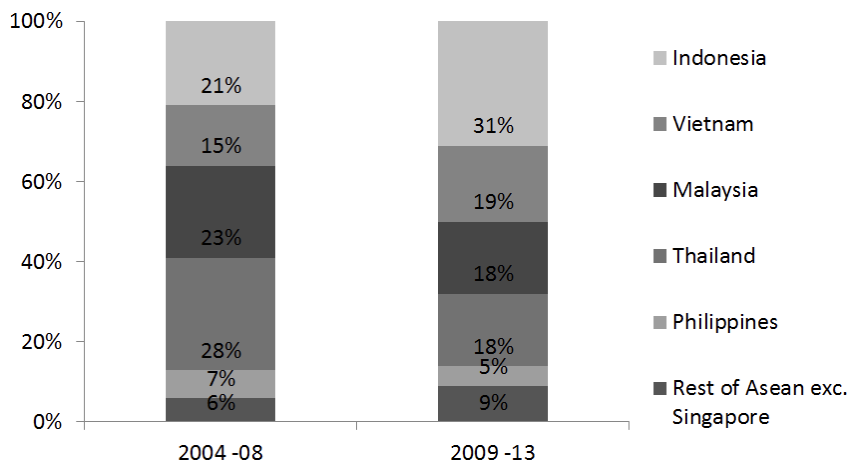

ASEAN FDI Market Share (in %)

Vietnam attracted increasing FDI since integrated into the world trade, from 15% of total FDI market share to 19% during 2009-2013. In 2007, the real FDI was 6 US$ billion and in 2008, this number jumped to 11.5 US$ billion in 2008, while the registered capital rose significantly to 71,7 US$ billion, the highest number in the history, thanks to the information that Vietnam joined WTO.

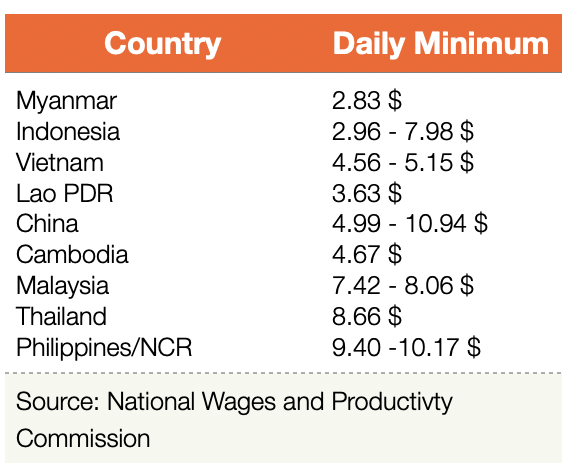

Wages

In term of daily minimum salary, Indonesia and Vietnam have the advantage of comparative lower wages than China, at about two third and only half of Thailand’s wages.

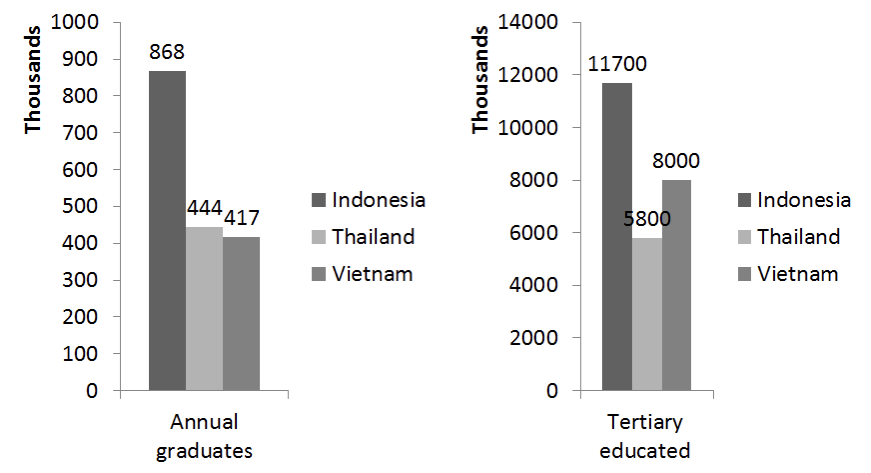

Education

In order to attract foreign investors to the region, respective countries shown their commitment to have greater spending on education from national budget. Indonesia is leading in both charts because of above reason and its demographics bonus.

Annual Graduates & Tertiary Education

Infrastructure

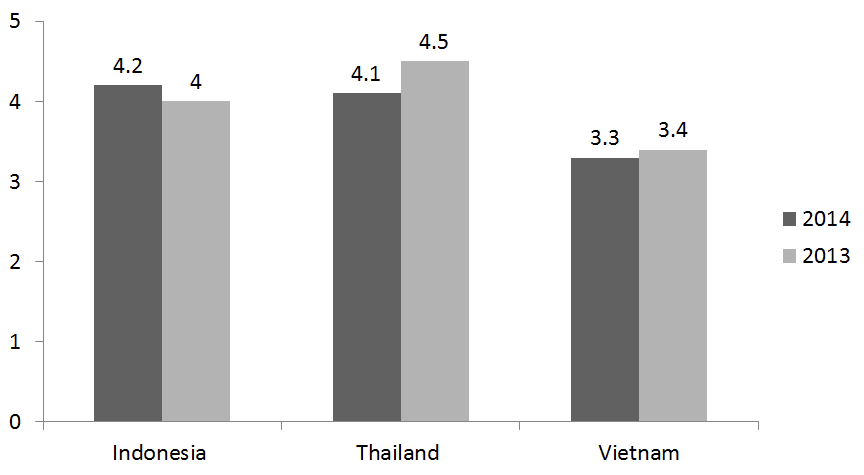

The global competitiveness report ranks countries based on its quality of general infrastructure (eg. transport, telephony and energy). In below chart, Indonesia is overtaking Thailand and is the only country in showing improvement in quality.

Infrastructure Quality Rating in ASEAN

Scale: 1 = extremely underdeveloped, 7= extensive and efficient by international standards. Source: WEF, Global Competitiveness Report 2014-15

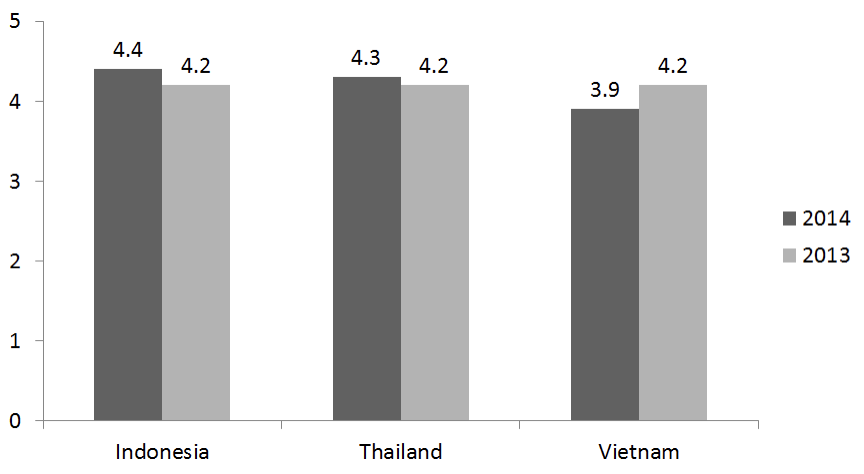

Ease of hiring foreign staff

Indonesia rated as the most open country in the region for hiring foreign labour in comparison to Thailand and Vietnam.

Rating for Ease of Hiring Foreign Staff

Scale: 1 = very complicated to hire foreign staff, 7= no limits to hire foreign staff. Source: WEF

Rising Stars in Southeast Asia – Business Opportunity Analysis