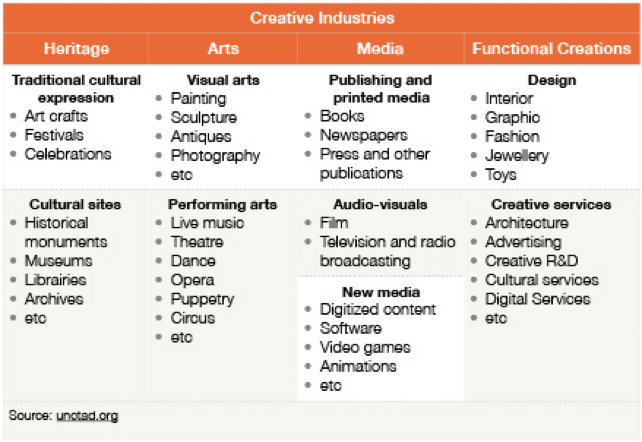

United Nations Conference on Trade and Development or UNCTAD has introduced the creative industries which are at the crossroads of the arts, culture, business and technology. All these activities are intensive in creative skills and can generate income through trade and intellectual property rights.

The Thai government has adopted UNCTAD’s creative economy model, with some classification adjustments according to UNESCO. The focus industries divided into culture and non-culture categories and four sub-categories: cultural heritage, the arts, media, and functional creation.

In January 2015, BOI “seven-year investment promotion strategy” was effective. The new investment promotion strategy is focusing on high technology and creative and digital economy activities, as well as the industries that are developed from domestic natural resources. The approved project will be granted two years extra on corporate income tax exemption. TCDC (Thailand Creative & Design Center) is another organisation who works as a resource and information center in creativity and design to exceed the capacity of Thai designers and entrepreneurs in the global market. TCDC has it’s center in Bangkok, Chiang Mai and will be opened in Khon Kaen in 2018. Based on our analysis and interviews we decided to focus on Software industry and Digital content industry which we see the strong potential for EU companies.

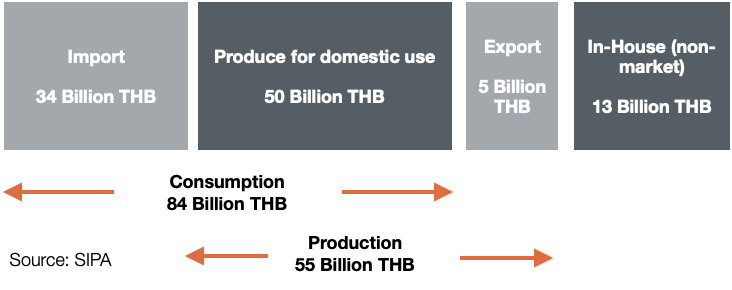

Software market value 2014

Software Industry

Thai software industry valued 54,980 million baht in 2014 (61,145 million baht including embedded software), which is 9.4% growth from last year. Package software valued 15,031million baht (4.5% growth), embedded software value 6,165 million baht (6% growth) and ITO service valued 39,949 million baht (11.4% growth). Software export grew 6.1% in 2014. The software industry is expected to grow 12.8% in 2016.

Key stakeholders

Thailand is an attractive software investment location. It has a reliable electricity supply and a stable internet connection via fiber optic and ADSL broadband. There are skilled and affordable workforce approx. 50,000 employed in software industry (2012) and there are approx. 17,000 new graduated every year.

Opportunities in Software industry

According to the Software market value, Thailand software production could not serve domestic demand. Thailand still import software package valued 33,751million baht. This is an opportunities for Swedish/EU companies to enter the market by exporting package software or invest in developing the software in Thailand.

People go online – There is a need of new technology to serve the new lifestyle; mobile devices, e-commerce, cloud computing, IoT and wearable devices. There are many benefits from other industries growth which is an opportunity for software industry such as payment system in retail e-commerce industry still need to developed.

“Thailand 4.0”, the country’s strategy is to drive Thailand by innovative technology to improve quality of life, productivity and efficiency for all businesses in the nation. Software industry has a very strong support from Thai government. Software industry will benefits from the strategy and BOI attractive tax and non-tax incentives. BOI granted up to 8-year corporate income tax (CIT) to software enterprise in the promoted zone: Phuket and Chiang Mai. Industry challenges

Industry challenges

Technology changes and Thailand need to follow new technical trends and need to upgrade the skills of workers. – Software Park Thailand’s director Thanachart Numnonda says that AEC 2015 represents both an opportunity and a threat for the Thai software industry. Market will be bigger and at the same time more competition. He says Thailand’s software industry will need to develop and upgrade the quality of its human resources with international certifications and specialized education about emerging technologies such as mobile applications and cloud computing.

Language barrier – From an interview with Iwa Labs (Thailand) Co., Ltd., Thai programmer is very qualify and affordable. However, English communication skill might be lower than other Asian countries but it is not impossible to find English speaking programmers.

Animation and game industry

The animation market in Thailand is divided into seven sub-sectors: TV animation, animation character license fees, VCD/DVD animation, film animation, mobile animation, visual effects for television commercials (VFX for TVC), and VFX & post production. In 2011, TV animation accounted 40% and have a market value of US$75 million.

There are more than 50 Thai animation companies active in Thailand. According to Thai Animation & Computer Graphics Association, Thailand imported animation products in a value of 3,500 million baht, domestic production is 1,153 million baht, and export only 744 million baht in 2011. Thai nationality animations accounted only for 20% of what we produced, the rest 80% are foreign companies outsourcing in Thailand or produce abroad.

There are many talented Thai animator involved in animation movies and TV series.

- ShellHut entertainment is behind the animated TV series “Shelldon” which broadcast over 100 countries around the world.

- The Monk Studios, Thailand is one of the animation house behind “Rango” which won 82th Academy Award.

- “Zootopia” (2016) the latest animated film from Walt Disney Animation Studios, has been drawn by Fawn Veerasunthorn, a Thai story artist. She also drawn one of the most popular Disney animated film Frozen (2013).

There are 22 million online gamer in thailand. Gaming markets consists of six subsectors: online games, mobile/tablet games, handheld games, PC games, arcade games and game character licenses. In 2011, online gaming had the largest share at 48% market share with a value of US$140 million. MMORPG games are the most popular type of online games.

According to an interview with Managing Director of a production house Maewkayan-D Co., Ltd., Thai animators are skilled, creative and low labour cost but still there is a lack international content, management and capital.

Internet penetration in Thailand is increasing. There are 39,466,260 internet users in Thailand (2015). Home internet is developed and many area has access to fiber broadband internet. Broadband penetration is 9.52% per population. Population age 15-24 years use internet the most 58.4%, age 6-14 years use 54.1% and 25-34 years 33.5%. Mobile content will be in focus as the increasing of mobile internet user. Mobile subscriptions in 2014 is 83,053,966 or 123.52% of population. Moreover, 4G is available which make it easy to access to internet from mobile phone.

According to the report from Yozzo, There are more than 24 million people in Thailand who has smartphones and spend average 4.2 hours on the device. 90% of 18-24 years old access the internet daily via mobile phone.

Opportunities in Animation and game industry

Invest locally, creating a good content and sell domestic. Thailand imported animation value are still high, this means there is a lot to grow in the industry. Moreover, Thailand is a good outsourcing place due to a low labour cost. There are approx. 2,500 newly graduated animator every year with a lower salary than other neighbour countries. Many talented animator are working for international companies or working abroad due to a higher salary.

As internet penetration and smartphone users are rising, online game has a large market in Thailand. One of Swedish mobile game company is going to launch their game in 2016. They are translating and creating local content. By create a touch of localisation would make Thai people spend time and recommend the game to others, says team leader.

Industry challenges

Although Thai animator cost less than other neighbouring countries, Thailand’s animation production rank the 3rd in ASEAN after Singapore and Malaysia (2011). Thai animation industry still lack support, funding and good content. Singapore and Malaysia has better tax policy for foreign investors. Moreover, English proficiency is another challenge of Thai labour.

Digital content: Media and Advertisement

Technology plays a big roles in daily life. Everything and everyone goes online. Printed newspaper and magazine subscription declined. Thais consume news from their mobile devices. Television which is the primary source of news can be watched from mobile. Facebook live changes the live streaming experiences. Radio stations are also available online.

In 2016, there is 9,883 million baht spending on Digital Advertising. Facebook ad, Youtube ad and display ad are the top three advertisements. Following are Media agencies in Thailand, they cover approx. 80% of the market share.

Opportunities in the industry

Digital ad is a no ending story not like a printed ad that need to give the idea direct after seeing. Digital ad for one product can be created to a story. It need creativity to create a great content to increase the organic reach.

Industry Challenges

Many advertiser still not understand the importance of digital marketing and how it works. Media agencies need to adapt themselves to become digital agencies. It is not only increasing organic reach and create awareness, content need to increase engagement and drive to the buying stage.

Rising Stars in Southeast Asia – Business Opportunity Analysis