Thailand is positioning itself as a medical tourism hub and aims to be a cost-effective production location for pharmaceuticals and medical device companies. 2.35 million foreign patients from Japan, USA, South Asia, UK, Middle East, ASEAN countries came to Thailand in 2014. Most popular medical treatment is orthopaedics, heart surgery, cosmetic surgery and dental works.

The government spent 14% of its total budget on the healthcare which accounts for 4% of Thailand’s GDP (2015).

Healthcare sector

Thailand’s Healthcare Expenditure as Percentage of GDP

Source: World Bank 2015

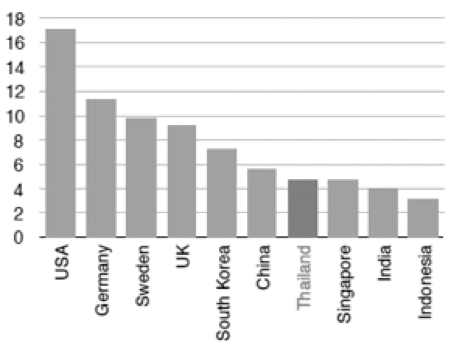

Thai government spent 376.3 million USD and private sector spent 120.4 million USD for health care. Thailand spent 242.8 USD per capita in health 2012 which is the highest in ASEAN however, it is still low compared with the US which spent 8,608 USD per capita.

Thailand imported nearly 80% of the medical equipment to a value of 1.1 billion USD in 2015. Thailand has Asean’s largest diagnostic Imaging market. Asean countries currently import most of their medical equipment such as ultrasound, x-ray machines and MRI scanners from the US, Japan, Germany and the Netherlands.

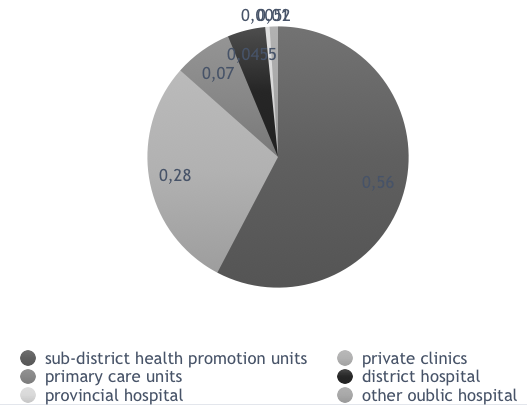

There are more than 17,000 health care facilities in Thailand (2015). Estimated 70% of all facilities are public. There are 336 private hospitals in the country, of those are 53 accredited by Joint Commission International (JCL). The hospital beds per person is 21 per 10,000 people which is near the global average of 26.

Healthcare facilities in Thailand (%)

Thailand implemented the universal healthcare coverage in 2002. The policy covered about 99 percent of the Thai population by the end of 2013. Moreover, the government is focusing on prevention and control practices by giving annual check-ups for major diseases such as HIV, blood pressure, cervical cancer, blood sugar and x-ray for patients with high risk of contracting tuberculosis.

The private healthcare sector plays an important role in the medical tourism industry. The government is encouraging the private sector to make greater investments in research and development.

Key Private Hospital chains in Thailand

The healthcare sector is a big and growing market, especially in the private sector which expand to support the middle-high income society. Big chain hospitals have started to buy the smaller independent hospitals to strengthen their brand. For example, Bangkok Dusit Medical Services (BDMS) were planning to have 50 hospitals by the end of 2016 (It was 42 hospitals at the end of 2015). The estimated investment in healthcare sector in 2017 is 70 billion THB, and if including the big investment of BDMS last year, the estimate will almost be 100 billion THB. The private hospital chains also see opportunities in the neighbouring countries. Bamrungrad, BDMS and Thonburi have already established branch hospitals in other countries.

In 2010, public hospitals had to limit their purchases according to the Central Price Regulation procurement policy from the Ministry of Public Health. The prices of medicine and medical devices market has been pressed to a very low level. Competitive pricing is the key win the tenders, which often are closed reversed actions.

Pharmaceutical sector

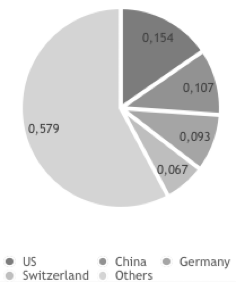

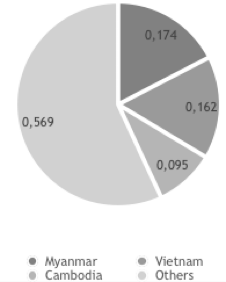

There were 171 local manufacturers and 650 importers in the pharmaceutical industry (2011). The distribution channels of major medicines are via hospitals (62.5%), pharmacies (26.3%), ambulatory health settings (6.5%), and other channels (4.7%). Thailand’s export of pharmaceutical products has been growing with 6.12% under the past five years. The main export countries are Myanmar, Vietnam and Cambodia. US was the largest supplier of pharmaceuticals which accounts for 15.4% of total imports. (2015)

Thailand Pharmaceutical

Expenditure (%)

Export (%)

Thailand also offers also well-developed clinical trial infrastructures. It gives the large target population, qualification and credentials of researchers, low costs and good clinical capabilities and high standard.

Key International Pharmaceutical companies in Thailand

Medical Device sector

The medical tourism is increasing the demand of medical devices. The Thai government provides support for new development and innovation, for example, the Thailand Center of Excellence for Life Sciences (TCELS) was founded in 2004.

TCELS has the responsibility of providing a link between innovation in life sciences and investment, and spurring domestic and international partnership in the life science business in Thailand. The focus areas are:

- Pharmaceuticals and biotechnology – Pharmacogenomics

- Natural products

- Biomedical engineering in medical robotics, medical devices, and operates the Advanced Dental Technology Center (ADTEC)

- Medical services such as Advanced Cell and Gene Therapies Program and Automated Cell and Tissue Production Plant.

Thailand increase the capability to provide one-stop solutions and deliver innovative diagnostic kits in biochemical space and the electronic field. Moreover, TCELS has established a Center for Advanced Medical Robotics and aim to be a research base for international and regional users.

Key International Medical Device companies in Thailand

Opportunities in the industry

- Aging Population in Thailand is increasing. Life expectancy is 74.9 (WHO, 2015). In 2005, the ratio of senior citizens was 5% of the population and 12% in 2014. It is estimated that in 2025 will be 25%. There will be needs of many business such as food provision, medical equipment, pharmaceutical, health services, and nursery and home-care services.

- Medical device sector can take advantage of BOI’s Super Cluster which gives 8 years income tax exemption and additional 50% reduction of corporate income tax for 5 years.

- Many medical devices are manufactured in Thailand, the rising demand of the high-grade and sophisticated medical devices are being imported and still leave rooms for new investments.

- There are still large opportunities for new investors in the pharmaceutical sector as Thailand imports most active pharmaceutical ingredients overseas.

Industry challenges

- The Central Price Regulation procurement policy gives pressure to the companies to set a competitive and low price.

- Limited healthcare resources can hold back the industry. There is a ratio of 1:3,347 medical worker per population but WHO requires 1:1,000. Number of doctor is 4 per 10,000 population which is much lower than the global average which is 13. This cause the doctors to work overtime, at the public hospital and private hospital. Moreover, many doctors has their own private clinic in the evening.

Rising Stars in Southeast Asia – Business Opportunity Analysis